January 10th 2022

Financial Wellbeing

What is Financial Wellbeing?

- It’s about a sense of security, having a financial safety net

- It’s feeling that you are in control of your day-to-day finances to meet your commitments

- It’s having the financial freedom to make decisions that allow you to live life to the full

A new year is usually a time when people make resolutions, set goals and plan for the future.

These approaches can contribute to our overall health and wellbeing, allowing us to move forward

and feel secure, despite the challenges and changes that life can throw at us.

As many of us embrace 2022 with positivity, there are many also concerned with the cost of

living increases, job losses, lack of investment opportunities and a general uncertainty around

finances and economic instability.

Evidence shows that there are strong links between financial wellbeing and other pillars or

steps to our overall health and wellbeing.

Your mental health can affect how you deal with your finances and vice versa. Mind.org.uk

outlines some common ways that this can happen:

- You may lack motivation to manage your finances

- Spending may give you a brief high, so you might overspend to feel better

- You might make impulsive financial decisions

- Your income might be affected

- You might avoid doing things to stay on top of your money or paying your bills

- Insurance premiums may increase

In a recent webinar, debt advice and community organisations shared stories of individuals and

families struggling to pay their bills; facing unemployed; living with benefit changes; having a

lifestyle paid for by credit or just an overall lack of education and awareness around the need

to consider financial wellbeing for all of us.

The work that we do to supporting the wellbeing of women living with perimenopause and menopause

and with family carers also highlights the financial implications for those leaving employment,

going part time and what that looks like for national insurance contributions and pension pots.

Young people too, tell us that there is a lack of accurate and accessible information to support

them in their financial decision making.

A lack of financial wellbeing can cause stress, anxiety, isolation, poor decision making and

barriers to good planning for the future, in turn having a negative impact on the other

wellbeing aspects in our lives.

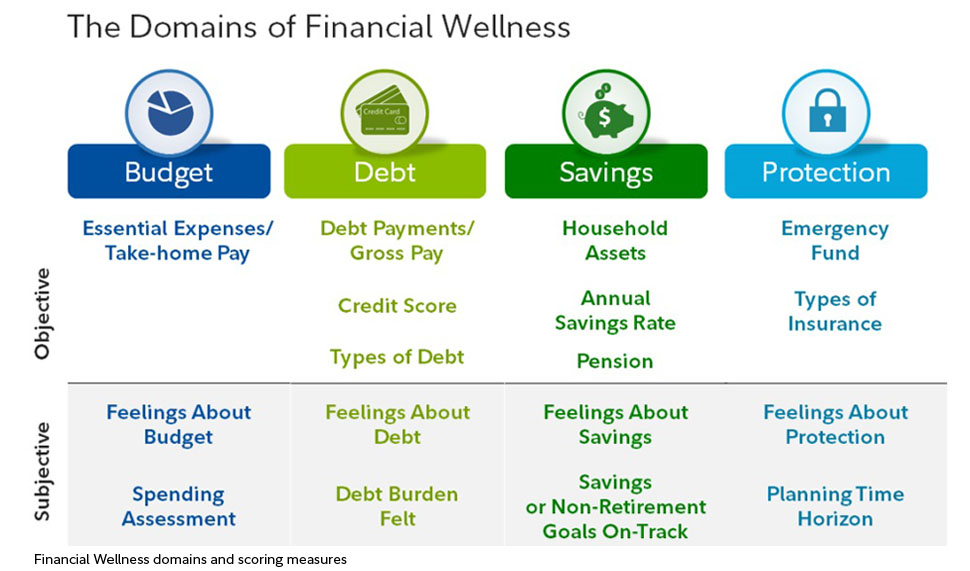

For many, just thinking about financial wellbeing, as outlined in the Financial Wellness Domains

from Fidelity Investments below can see overwhelming, too complex or just something to put on

the long finger.

The good news is that there are a number of things that you can do to achieve financial wellbeing and these include:

- Evaluating your financial situation

- Designing and stick to a practical budget

- Building your savings

- Searching the right investments

- Creating an emergency fund

- Having a retirement plan

- Focusing on financial education

- Tracking your credit card limits on your credit score

- Thinking before applying for a loan

These all sound like straight forward and relevant tips if you are in a position to understand

and action them. However, there are a number of complexities around financial wellbeing, the

impact of the pandemic and the wider determinants of health and wellbeing that affect

individuals.

The Wellbeing Pathway is delighted to be working in collaboration with the Money Guiders

Network, funded by the Money and Pension Service (MaPS). As part of this collaboration, we are

now members of the NI Financial Wellbeing Forum, jointly chaired by MaPs and the Department for

Communities. This means that we will be able to access training and information with up-to-date

factual information and guidance to support people in their financial wellbeing. We want to help

reduce the stigma around debt, encourage investment and planning, and create opportunities for

learning around financial wellbeing that will contribute to overall health and wellbeing across

our communities.

Catherine Murnin

The Wellbeing Pathway Founder